What does “Workers’ Compensation Benefits” mean?

Injured workers are entitled to benefits if their claim is accepted (meaning their injury is work-related) and they can’t perform their regular duties because of it (either they are placed off work or the department cannot accommodate work restrictions). These benefits compensate injured workers for their lost time caused by the work-related injury, with a focus on helping them return to their regular job duties.

Strictly on the University side, when an employee is unable to work their regular schedule, the department opens a leave case with AggieService, and a leave is entered into UCPath. This keeps track of when the employee isn’t working and lays the groundwork for applying for disability benefits if needed.

There are three kinds of Workers’ Compensation benefits: 1) Total Temporary Disability; 2) Wage Loss and 3) Permanent Disability.

Total Temporary Disability (TTD) is paid when an injured worker is not working at all. TTD pay is calculated from the injured worker’s salary for the 52 weeks before the injury, and it is two-thirds of that salary. Sedgwick will pay the injured worker TTD every two weeks until they are cleared to return to work. In most cases, there is a legally mandated three-day waiting period before payments start.

Wage Loss is paid when an injured worker is still able to work a portion of their shift (e.g., a full-time employee is cleared to work only 20 hours a week). The University will pay the salary owed for any regular hours worked, while Sedgwick will pay two-thirds of the salary covering the remaining hours in the employee’s regular schedule.

Injured workers are entitled to 104 weeks of TTD and Wage Loss benefits.

Permanent Disability is paid to an employee when Total Temporary Disability and Wage Loss benefits have ended and the employee has been medically evaluated and found to be permanently disabled.

When do benefits start?

Legally, Sedgwick has up to 90 days to decide whether to accept or deny a claim. Until the claim is accepted, Sedgwick will not pay any benefits to the injured worker, even though they might not be working. When the claim is accepted, Sedgwick obtains the worker’s salary information for the 52 weeks before the injury and determines if the waiting period applies. Sedgwick then prepares and sends out payment checks (paper only, direct deposit is not available).

What are employees supposed to do while waiting for a decision?

Workers’ Compensation claimants should always consider that it might take up to 90 days before Sedgwick decides to accept a claim. Injured workers who are placed off work on the same day the injury or illness occurred should use regular time for that day only and would need to consider how to cover the remaining days off.

During that time, injured workers can:

- Use sick or vacation leave to cover the days not worked.

- Apply for short-term disability benefits.

- Go without pay during this time.

Using leave accruals (sick, vacation, comp time) to cover the days not worked ensures that injured workers are paid and remain on pay status so they continue to receive benefits like health insurance. This is the option most employees choose because they will receive a steady income to cover household expenses. Also, if the claim is denied, there are no issues with having to return any overpayments.

Voluntary Short-Term Disability is an option for the injured worker still wants to be paid for their time not working, but who doesn’t want to use all their sick leave. It will pay 60 percent of earnings up to $15,000 monthly. Basic Disability doesn’t cover work-related injuries or illnesses, so injured workers will need to have Voluntary Short-Term Disability coverage. Voluntary Short-Term Disability allows employees to remain on pay status and have their benefits covered. Like with using leave accruals, there are no overpayment concerns if the claim is denied. Learn more about the available types of disability coverage.

Going without pay is problematic for most employees because of the need to cover household expenses, but it is still an option if there are no leave accruals, the injured worker doesn’t have voluntary short-term disability insurance or can manage without pay temporarily. However, not being on pay status means no benefit deductions, which may not be a big issue for a few days but could become significant over time.

How do Supplemental Benefits work?

The University’s Supplemental Benefits program helps injured workers by ensuring they receive nearly full pay while recovering and unable to work their regular schedule. Supplemental benefits are available to employees who have enough sick or vacation leave. When employees receive supplemental benefits, they remain on pay status as if they were working normally, which lets tjhem keep covering their premiums.

Supplemental benefits kick in once Sedgwick begins paying TTD pay or Wage Loss pay. Sedgwick communicates directly with UCPath to make sure the remaining one-third of earnings get paid using the employees' leave accruals.

How does UCPath calculate supplemental benefits?

UCPath calculates supplemental benefits using a formula that includes the amount owed after Sedgwick has paid benefits and the hourly wage at the time of injury. Using this formula, UCPath determines how many hours of leave are needed to “buy” the remaining one-third of earnings that Sedgwick does not pay. That amount, minus any deductions owed, is paid to the employee.

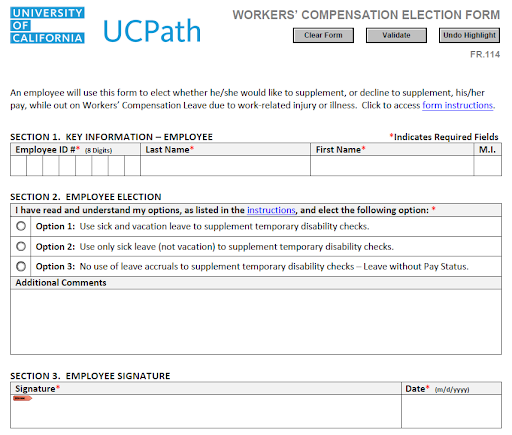

Employees do not have to use all their leave for supplemental benefits. When the department opens a leave case, the service channel will send the employee a packet that contains documentation about the leave process. This packet (which comes via email) includes the Workers’ Compensation Election Form, which looks like this:

The form allows employees to choose to supplement with sick leave, both sick and vacation leave, or not at all. It’s important to complete this and return it as soon as possible because UCPath will supplement using sick leave by default if the form isn’t returned.

If employees choose to supplement with both sick and vacation leave, UCPath will use sick leave first and then use vacation leave.

Employees who do not receive the form within a few days after their leave should contact Workers’ Compensation immediately.

The last option – electing not to supplement at all – will result in Leave Without Pay status.

What happens when an employee used leave accruals to get paid and then receives pay from Sedgwick?

UC Davis has overpaid the employee. When an employee uses leave accruals to be paid for a period when they didn't work, UC Davis issues them a check.

If Sedgwick also pays the employee for the same period after accepting the claim, the employee ends up being overpaid. It's important to note that Sedgwick, not UC Davis, is responsible for paying time when the employee does not work.

Even if an employee completes the election form and chooses to supplement their pay, UC Davis would be responsible for a maximum of one-third of earnings (minus any deductions and assuming Sedgwick is paying Total Temporary Disability pay). UCPath will contact the employee to arrange repayment of any overpaid amounts.

UC is self-insured. Why is this even an issue?

Although the University of California is self-insured, having an outside administrator handle claims means that claims questions are handled independently and impartiality, with the primary goal adherence to Workers’ Compensation laws and regulations.

While Sedgwick reviews and decides on the vast majority of claims pretty quickly, the quickness of an investigation depends on a lot of factors out of their examiners’ control – for example, medical records might take weeks to obtain, which delays a claim decision. The options available to employees like using leave accruals or disability insurance are intended to help support them and guarantee a steady income while Sedgwick decides on a claim.

What happens if I run out of leave accruals and cannot supplement anymore?

If an employee is still off work and receiving benefit payments from Sedgwick, they can supplement until they exhaust their leave accruals. At this point, eligible employees who qualify for Extended Sick Leave will receive the difference between temporary disability pay and 80 percent of their salary (minus any benefit deductions). Extended Sick Leave expires after 26 weeks (or 182 days).

After Extended Sick Leave expires, employees would be placed on Leave Without Pay. If they are still receiving Temporary Disability payments, their insurance premiums will be covered by the University’s Contingency Fund. However, if they are no longer receiving Temporary Disability, they will be responsible for paying 100% of their insurance premiums.